The automotive industry is undergoing a historic transformation. As the world accelerates its transition from internal combustion engine (ICE) vehicles to electric vehicles (EVs), traditional automakers—longstanding giants in the industry—are grappling with the complex task of not only adapting to technological innovations but also navigating intensifying market competition. The rise of electric mobility, coupled with the growing pressure from government regulations, consumer demand, and emerging disruptive competitors, means that these companies must urgently evolve or risk falling behind.

This transformation is not just about adopting a new powertrain; it involves a fundamental shift in everything from manufacturing processes and supply chains to business models and brand positioning. For established players like Volkswagen, Toyota, Ford, and General Motors, the transition from ICE vehicles to electric vehicles (EVs) is fraught with challenges but also rife with opportunities.

This article delves into how traditional carmakers are responding to the twin pressures of market competition and technological innovation as they navigate the road to electrification.

1. Transitioning to Electrification: A Technological Leap Forward

Rethinking the Core Technology

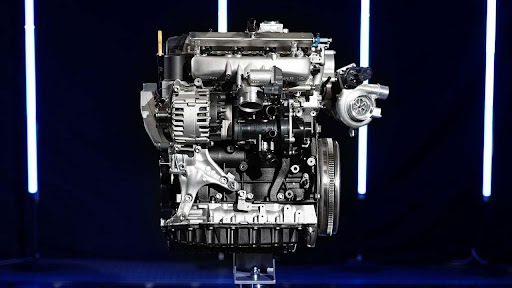

The most apparent and significant challenge for traditional carmakers is the shift from internal combustion engines (ICEs), which have been at the core of their vehicle production for over a century, to electric drivetrains. Unlike traditional vehicles, electric vehicles use a simplified powertrain composed of an electric motor and battery, which introduces new challenges in terms of design, production, and performance standards.

- Reengineering the vehicle: Electric drivetrains are fundamentally different from ICE systems. As a result, carmakers are having to redesign vehicles to accommodate large battery packs, electric motors, and the necessary battery management systems (BMS). This requires completely retooling manufacturing plants and rethinking design and engineering processes that were optimized for traditional gasoline-powered engines.

- Battery technology: One of the most critical components of an EV is the battery, which not only powers the vehicle but also significantly influences performance, range, cost, and safety. For traditional carmakers, the need to invest in battery technology has become a key focus. The development of longer-lasting batteries, faster charging systems, and battery recycling technologies is paramount to achieving market success.

The Role of Software and Digitalization

In addition to hardware changes, the shift to EVs also introduces the need for significant advancements in software. Unlike ICE vehicles, EVs rely heavily on software-driven features such as battery management systems, over-the-air (OTA) updates, and autonomous driving systems. This puts traditional automakers in direct competition with tech companies like Tesla, which have already built software-centric ecosystems.

- Over-the-air updates (OTA): While traditional automakers have focused primarily on hardware, the success of EV brands like Tesla has demonstrated the importance of integrating software into the vehicle experience. Tesla has pioneered OTA software updates, which allow vehicles to improve over time without requiring customers to visit a service center. Legacy manufacturers are now scrambling to develop similar capabilities and build their own connected car ecosystems.

- Autonomous driving: Many traditional automakers are investing heavily in autonomous driving technologies—a key feature for future EVs. However, traditional carmakers face the dual challenge of both developing cutting-edge software and partnering with tech companies or building in-house expertise to integrate AI and machine learning into their vehicles. This technological shift requires not only heavy investments but also a change in mindset from focusing on physical vehicles to digital ecosystems.

2. Market Competition: Rising Pressure from New Entrants and Tech Giants

The Tesla Effect

Perhaps the most significant competitive pressure on traditional automakers is the rise of Tesla, which has redefined what a car brand can be in the 21st century. Tesla’s electric-first approach, combined with cutting-edge software, direct-to-consumer sales, and massive brand loyalty, has disrupted the entire automotive industry.

- Brand recognition: Tesla’s dominance in the EV market has forced legacy carmakers to rethink their strategies. Companies like Volkswagen, Ford, and General Motors now face the difficult task of catching up to a brand that is widely seen as a leader in electric mobility and autonomous driving.

- Agility and innovation: Traditional carmakers, which have decades of experience in manufacturing and selling ICE vehicles, often face significant organizational inertia when trying to pivot to electric mobility. In contrast, new entrants like Rivian, Lucid Motors, and NIO have the advantage of being agile, with fewer legacy processes to overhaul. Their ability to innovate without the constraints of historical infrastructure is a key factor in their rising prominence.

Tech Giants Enter the Market

In addition to electric-only startups, tech companies such as Apple, Google, and Amazon are increasingly eyeing the automotive sector. With deep pockets, advanced technology expertise, and vast consumer ecosystems, these companies pose a new threat to traditional carmakers.

- Tech integration: Unlike traditional automakers, tech companies like Apple and Google bring a wealth of expertise in software development, artificial intelligence, and cloud computing, which are critical in the development of connected cars, autonomous driving, and in-car entertainment systems.

- Disruption of distribution models: Many tech companies are also leveraging their ability to build direct-to-consumer platforms. If tech giants decide to build vehicles, they can bypass traditional dealerships and create a more seamless customer experience, offering consumers integration with smart home devices, cloud-based services, and a fully connected ecosystem.

The Rise of Chinese Manufacturers

Another factor intensifying market competition is the entry of Chinese electric vehicle manufacturers, which are expanding rapidly and gaining traction in global markets. Companies like BYD, NIO, and XPeng Motors have significant backing from both private investors and the Chinese government, giving them a competitive advantage in terms of both capital investment and government incentives.

- Global expansion: Chinese EV makers are targeting both local markets in China and international markets, including Europe and North America. Their competitive pricing and government-backed subsidies are allowing them to gain market share quickly, forcing legacy automakers to reassess their global strategy and pricing models.

- Technology transfer: Many of the Chinese EV manufacturers have leapfrogged traditional automakers in terms of battery technology, infotainment systems, and autonomous driving capabilities. Their ability to integrate these technologies at lower costs is posing a serious challenge to legacy manufacturers, who are now forced to catch up.

3. Responding to the Dual Pressures: Strategies for Traditional Automakers

1. Large-Scale Investments in EV Technology

To survive and thrive in an electric-first future, traditional automakers must embrace large-scale investments in EV technologies. Many established companies are shifting their focus and pouring billions of dollars into the development of electric vehicles.

- Dedicated electric platforms: Automakers like Volkswagen and General Motors are investing in dedicated EV platforms. These platforms are designed specifically for electric mobility, enabling companies to manufacture a variety of models on the same architecture. This modular approach helps streamline production and reduces costs.

- Battery partnerships and Gigafactories: Many legacy automakers have forged partnerships with established battery makers such as LG Chem, Panasonic, and CATL. Some have gone a step further, investing in or building their own gigafactories to secure a steady supply of batteries and bring down costs. Volkswagen, for example, has committed to building several gigafactories across Europe to increase its battery production capacity.

2. Embracing Software and Connectivity

Traditional automakers are realizing the importance of software in the future of mobility. As electric vehicles are increasingly driven by digital interfaces, automakers must invest heavily in software development and create their own digital ecosystems to compete with the likes of Tesla and tech giants.

- In-car software platforms: Companies like BMW, Ford, and Mercedes-Benz are shifting toward the development of in-car software platforms that allow for a seamless user experience. These platforms will enable features such as OTA updates, personalized driving experiences, and connected services that make the car an integral part of the consumer’s digital life.

- Autonomous driving: Traditional automakers are also investing in autonomous driving technologies, either through in-house development or strategic partnerships with AI companies. This will help them remain competitive in a world where self-driving cars are expected to be the norm within the next decade.

3. Streamlining Production and Improving Efficiency

The ability to streamline manufacturing processes and reduce costs is essential for traditional carmakers to compete with emerging players and tech companies.

- Flexible manufacturing: Automakers like Ford and General Motors are investing in flexible manufacturing systems that allow them to produce both traditional ICE vehicles and electric vehicles on the same production lines. This flexibility helps them manage the transition to electric mobility while maintaining profitability.

- Supply chain optimization: Traditional automakers are also working to **optimize their

supply chains** by building strong relationships with battery suppliers, securing access to key materials like lithium and cobalt, and investing in recycling technologies to ensure the long-term sustainability of their supply chains.

Conclusion: Navigating the Dual Pressures of Technological Change and Market Competition

The transformation of the automotive industry is a complex and multifaceted process. For traditional automakers, the shift from internal combustion engines to electric vehicles is not just a technological challenge but also a test of their ability to adapt to rapid change while maintaining competitive market positions. The twin pressures of technological innovation and market competition from both new entrants and tech giants require a balanced strategy of investment in electrification, digital transformation, and supply chain reengineering.

Ultimately, the legacy giants that can successfully navigate this transformation will emerge as key players in the future of mobility, while those that fail to adapt may find themselves sidelined in a rapidly evolving market. The road to electrification is long and challenging, but with the right investments, traditional automakers can still secure a dominant position in the new era of transportation.