Introduction

The electric vehicle (EV) industry stands at a pivotal juncture, driven by rapid advancements in battery technology. As the cornerstone of EV performance, batteries directly influence cost, range, safety, and sustainability. Breakthroughs in energy density, charging speed, cost reduction, and lifecycle management are poised to redefine the sector’s trajectory. This article explores how these innovations will catalyze transformative shifts in EV adoption, manufacturing, and global energy ecosystems.

1. Enhanced Energy Density: Extending Range and Market Acceptance

1.1 Current Limitations and Technological Progress

Traditional lithium-ion batteries have faced challenges in energy density, limiting EV range to 300–500 km per charge. However, innovations such as solid-state batteries and silicon-anode technology are pushing energy density beyond 400 Wh/kg, enabling ranges exceeding 800 km . For instance, companies like QuantumScape and Samsung SDI are developing solid-state batteries that eliminate flammable liquid electrolytes, simultaneously improving safety and capacity.

1.2 Impact on Consumer Behavior

Extended range directly addresses “range anxiety,” a major barrier to EV adoption. With ultra-high-density batteries, EVs can rival fossil-fuel vehicles in long-distance travel, accelerating market penetration. Analysts predict that by 2030, 70% of new EVs will feature batteries with energy densities above 350 Wh/kg, making them viable for commercial fleets and heavy-duty transport .

1.3 Diversification of Battery Chemistries

Beyond lithium-ion, emerging technologies like sodium-ion batteries and lithium-sulfur batteries offer cost-effective alternatives. Sodium-ion batteries, for example, leverage abundant raw materials, reducing geopolitical dependencies on lithium and cobalt. CATL’s recent sodium-ion battery launch highlights this shift, targeting mid-range EVs with 15–20% cost savings .

2. Fast-Charging Infrastructure: Redefining Convenience

2.1 Breakthroughs in Charging Speed

Current fast-charging systems require 30–60 minutes to reach 80% capacity. Advances in high-rate charging and thermal management are slashing this time to under 10 minutes. Technologies like 800V architectures (used in Porsche Taycan) and ultra-conductive electrolytes enable charging rates of 6C–8C, minimizing downtime for users .

2.2 Infrastructure Expansion and Grid Integration

The proliferation of 350 kW ultra-fast chargers necessitates upgrades to power grids and renewable energy integration. Companies like Tesla and ChargePoint are collaborating with utilities to deploy battery-buffered charging stations, reducing peak-load stress. By 2030, over 50% of public chargers globally are expected to support 150 kW+ charging, aligning with next-gen battery capabilities .

2.3 Economic Implications

Faster charging enhances the viability of EV ride-sharing and logistics networks. For example, Amazon’s electric delivery vans, powered by Rivian’s high-speed charging systems, can recharge during short loading periods, optimizing operational efficiency.

3. Cost Reduction: Accelerating Mass Adoption

3.1 Declining Battery Prices

Battery costs have plummeted from 1,200/kWhin2010tounder1,200/kWhin2010tounder100/kWh in 2024, driven by economies of scale and innovations like cell-to-pack (CTP) designs. Tesla’s 4680 cells, which reduce structural components by 50%, exemplify this trend, aiming for $60/kWh by 2030 . Such reductions could push EV prices below ICE vehicles, even without subsidies.

3.2 Material Innovations and Supply Chain Resilience

The shift to low-cobalt and cobalt-free cathodes (e.g., lithium iron phosphate, LFP) mitigates supply chain risks. BYD’s Blade Battery and Tesla’s LFP models have cut cobalt usage by 90%, aligning with ethical sourcing demands. Additionally, recycling initiatives recover 95% of critical metals, further lowering raw material costs .

3.3 Impact on Emerging Markets

Affordable batteries enable localized EV production in regions like Southeast Asia and Africa. India’s Tata Motors, for instance, plans to launch a $10,000 EV using domestically produced LFP batteries, democratizing access to clean mobility.

4. Safety and Durability: Building Consumer Trust

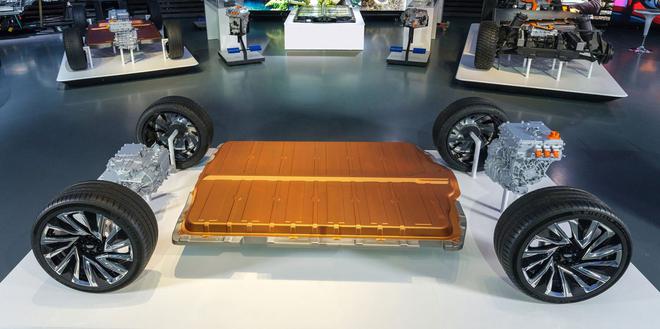

4.1 Thermal Stability and Fire Prevention

Battery fires, though rare, remain a concern. Innovations such as ceramic separators and self-healing electrolytes prevent thermal runaway. GM’s Ultium batteries incorporate patented nickel-cobalt-manganese-aluminum (NCMA) cathodes, reducing heat generation by 30% .

4.2 Extended Battery Lifespan

Improved cycle life—from 1,000 to 5,000 cycles—reduces replacement costs. BYD’s Blade Battery retains 80% capacity after 3,000 cycles, ensuring a 15-year lifespan. This durability supports second-life applications, such as grid storage, enhancing total economic value .

5. Sustainability and Circular Economy

5.1 Recycling and Resource Recovery

Closed-loop recycling systems, pioneered by Redwood Materials and Li-Cycle, recover 95% of lithium, nickel, and cobalt. EU regulations now mandate 70% battery material recycling by 2030, incentivizing automakers to design for disassembly .

5.2 Renewable Integration and Carbon Neutrality

EV batteries paired with solar/wind storage enable vehicle-to-grid (V2G) systems. Nissan’s Leaf V2G pilot in the UK allows users to sell stored energy back to the grid, offsetting charging costs and stabilizing renewable grids.

6. Global Industry Reshaping

6.1 Geopolitical Shifts in Material Sourcing

Countries rich in lithium (Chile, Australia) and graphite (China, Mozambique) are gaining strategic influence. Meanwhile, the U.S. Inflation Reduction Act prioritizes domestic battery production, reducing reliance on Chinese supply chains .

6.2 Job Creation and Skill Transitions

While battery gigafactories create manufacturing jobs, traditional auto sectors face disruption. Reskilling programs in Germany and the U.S. aim to transition fossil-fuel engineers to battery R&D roles.

Conclusion

Battery technology is the linchpin of the EV revolution, driving advancements in performance, affordability, and sustainability. As energy densities rise, costs fall, and recycling ecosystems mature, EVs will dominate global markets by 2040. Policymakers, automakers, and consumers must collaborate to harness these innovations, ensuring an equitable transition to a zero-emission future.