Introduction: The Intersection of Policy and EV Adoption

The transition to electric vehicles (EVs) represents a paradigm shift in transportation, driven not just by technological innovation but by deliberate government action. As climate change intensifies, nations worldwide are deploying policy tools—subsidies, tax incentives, infrastructure investments, and regulatory mandates—to accelerate EV adoption. This article analyzes how these policies shape market dynamics, influence consumer behavior, and address systemic barriers to decarbonizing transport.

Global Policy Frameworks: Subsidies, Regulations, and Beyond

1. Financial Incentives: Fueling Demand

Subsidies and tax rebates remain the cornerstone of EV promotion. China’s “New Energy Vehicle” program, which allocated 14.6billioninconsumersubsidiesbetween2016–2022,propelledthecountryto6014.6billioninconsumersubsidiesbetween2016–2022,propelledthecountryto607,500 per vehicle, targeting both consumers and manufacturers who source batteries domestically. Europe’s CO2 emission standards penalize automakers exceeding limits, indirectly subsidizing EV production.

2. Regulatory Pressure: Phasing Out Combustion Engines

Bans on internal combustion engine (ICE) vehicles have created binding timelines. The EU’s 2035 ICE phase-out, California’s 2035 zero-emission mandate, and India’s 70% EV sales target for commercial vehicles by 2030 compel automakers to redesign product portfolios. Norway’s aggressive tax exemptions (EVs pay no VAT or import duties) have made EVs 50% cheaper than ICE equivalents, resulting in 90% EV market share in 2023.

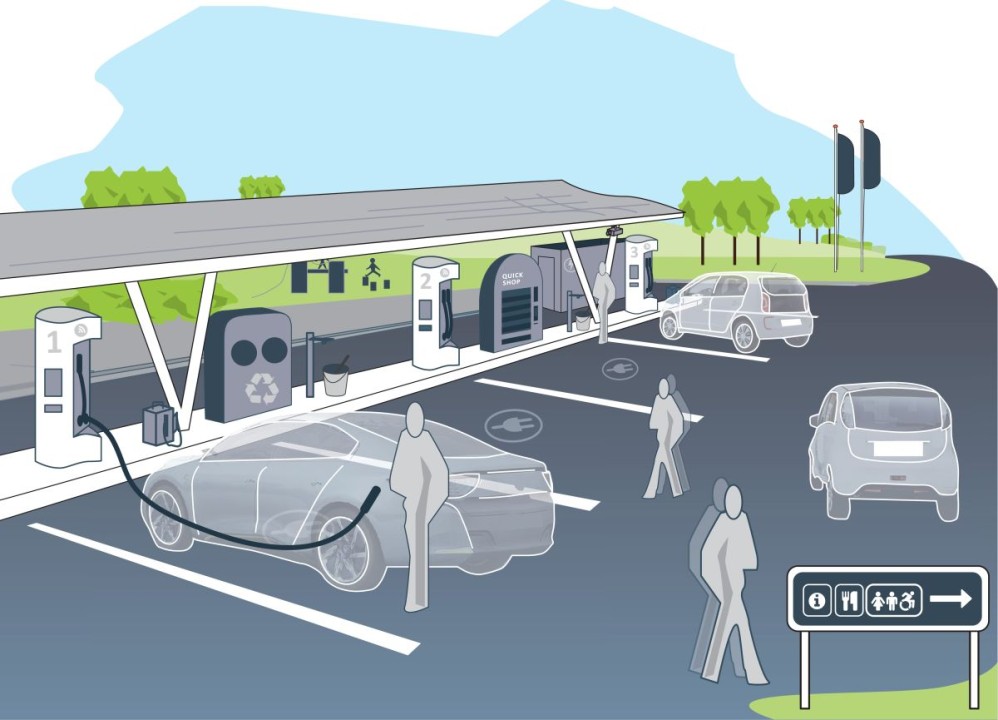

3. Infrastructure Investment: Addressing Range Anxiety

Public charging networks are critical to consumer confidence. Germany’s 6.4billioncharginginfrastructureplanaimstoinstall1millionchargersby2030,whileIndia’sFAME−IIschemeallocates6.4billioncharginginfrastructureplanaimstoinstall1millionchargersby2030,whileIndia’sFAME−IIschemeallocates1.3 billion to subsidize charging stations. China’s state grid operates 80% of the world’s fast chargers, ensuring 97% highway coverage.

Regional Case Studies: Divergent Strategies, Common Goals

1. China: Centralized Industrial Policy

China’s dual-credit system rewards automakers for EV production while penalizing ICE reliance. Combined with local manufacturing mandates for foreign firms (e.g., Tesla’s Shanghai Gigafactory), this policy mix turned China into both the largest EV market and exporter.

2. Europe: Regulatory Harmonization

The EU’s “Fit for 55” package integrates EV policies across 27 nations, mandating 55% CO2 reduction by 2030. France’s €7,000 subsidy and Italy’s 110% tax deduction for home chargers illustrate tailored national approaches within a unified framework.

3. United States: Federal-State Tensions

While federal tax credits under the IRA prioritize domestic supply chains, states like Texas and Florida resist EV mandates, creating market fragmentation. California’s Advanced Clean Cars II rule, adopted by 17 states, highlights subnational leadership.

4. Emerging Markets: Leapfrogging Challenges

India’s production-linked incentives (PLI) for battery manufacturing and Brazil’s 35% EV import tax reduction aim to balance affordability and industrial growth. Thailand’s 30% excise tax cut for EVs boosted sales by 400% in 2023.

Policy Impacts: Market Growth and Unintended Consequences

1. Accelerating Adoption Rates

Global EV sales surged from 2.6 million in 2020 to 14 million in 2023, with policy-driven markets (China, EU) accounting for 85% of growth. Norway’s EV penetration reached 90% in 2023, a 20-year outcome of consistent tax policies.

2. Supply Chain Reshaping

Local content requirements, like the U.S. IRA’s battery mineral sourcing rules, have triggered $52 billion in North American battery plant investments. Conversely, Indonesia’s nickel export ban—to capture battery refining value—sparked trade disputes with the EU.

3. Equity Concerns

Wealthier demographics disproportionately benefit from subsidies. Canada’s means-tested rebates (capped at $55,000 vehicle MSRP) and Spain’s EV loans for low-income households aim to democratize access.

4. Fiscal Sustainability

Subsidy costs strain budgets: Germany spent €3.4 billion on EV grants in 2022 but phased them out in 2023. Vietnam’s 50% registration fee waiver led to a 300% sales spike but cost 0.2% of GDP annually.

Future Directions: Policy Innovations for a Post-Subsidy Era

1. Smart Tariffs and Carbon Pricing

The EU’s carbon border tax (CBAM) and U.S. “battery passport” proposals aim to level the global playing field while penalizing high-emission imports.

2. V2G Integration and Grid Policies

California’s bidirectional charging mandate (2025) and UK’s vehicle-to-grid (V2G) trials incentivize EVs as grid assets, unlocking new revenue streams.

3. Circular Economy Mandates

The EU’s battery regulation requires 70% lithium recycling by 2030, pushing automakers like Volkswagen to build closed-loop supply chains.

4. Rural Mobility Solutions

India’s electric rickshaw subsidies and Kenya’s solar-powered charging hubs address last-mile connectivity gaps in underserved regions.

Conclusion: Policy as the Engine of Electrification

Government initiatives have proven indispensable in overcoming EV adoption barriers—high costs, infrastructure gaps, and consumer skepticism. Yet, as markets mature, policies must evolve from blanket subsidies to targeted, system-level interventions. By harmonizing industrial, environmental, and equity goals, policymakers can ensure the EV revolution delivers on its climate promise without leaving communities behind.